Blackwolf Mails and Files Special Meeting Materials in Connection With The Proposed Plan of Arrangement with Treasury Metals Inc.

ACCESS Newswire

06 Jun 2024, 04:31 GMT+10

VANCOUVER, BC / ACCESSWIRE / June 5, 2024 / Blackwolf Copper and Gold Ltd. ('Blackwolf' or the 'Company') (TSXV:BWCG)(OTCQB:BWCGF) announces that it has filed and mailed meeting materials for the special meeting of Blackwolf securityholders (the 'Meeting') to be held on June 26, 2024 at 10:00 a.m. (Vancouver time) in connection with the proposed plan of arrangement with Treasury Metals Inc. ('TML'), as previously announced on May 2, 2024.

The Arrangement

At the Meeting, holders of Blackwolf common shares (the 'Shareholders') and Blackwolf options (the 'Optionholders' and together with the Shareholders, the 'Voting Securityholders') will be asked to consider and vote upon a plan of arrangement (the 'Arrangement') between Blackwolf and TML pursuant to which TML will acquire all of the issued and outstanding common shares of Blackwolf. Each Shareholder will be entitled to received 0.607 of a TML common share for each Blackwolf common share held.

Your vote is important regardless of the number of Blackwolf common shares ('Shares') or options ('Options') you own. As a Voting Securityholder, it is very important that you read the Notice of Meeting, Management Information Circular (the 'Circular') and related materials with respect to the Meeting (collectively the 'Meeting Materials') carefully and then vote at the Meeting. You are eligible to vote if you were a Voting Securityholder of record at the close of business of May 21, 2024. You may vote in person at the Meeting or by proxy. The Meeting Materials are available under Blackwolf's profile on SEDAR+ at www.sedarplus.ca and on Blackwolf's website at www.blackwolfcopperandgold.com.

The Blackwolf Board of Directors and Special Committee UNANIMOUSLY recommend that Voting Securityholders vote IN FAVOUR of the proposed Arrangement.

Voting Securityholders are encouraged to vote well in advance of the proxy voting deadline on June 24, 2024 at 10:00 a.m. (Vancouver time).

Transaction Highlights

- Potential Near-Term Gold Production: Based on a prefeasibility study1 conducted in February 2023 by TML, the Goliath Gold Complex Project (the 'GGC Project') is poised for production with a forecasted 13-year mine life. It anticipates producing 109,000 ounces of gold annually at a cash cost1 of US$892 per ounce and an all-in sustaining cost (AISC)2 of US$1,037 per ounce during the first nine years. The prefeasibility study projected a net present value (NPV) of $493 million at a 5% discount rate, and an internal rate of return (IRR) of 33.5% based on a gold price of US$1,950 per ounce. The project benefits from readily available world class infrastructure and has secured a Federal Environmental Assessment approval. The final feasibility study and permitting processes are currently underway.

- Strong Financial Position: The balance sheet will be fortified with a combined cash position of more than C$10 million, plus a proposed concurrent flow-through financing for aggregate gross proceeds of up to approximately $6.4 million to be completed by TML prior the completion of the Arrangement.

- Enhance Capital Markets Focus: New capital markets strategy to be led by cornerstone investor Frank Giustra complements significant expertise in mine permitting, construction, operations, and exploration to create value for shareholders.

- Renewed Exploration Commitment: Exploration efforts are expected to be intensified with the Dryden, Ontario district, focusing on expanding the current mineral resource area. An experienced team will oversee these efforts, aiming to simultaneously advance development and exploration, maximizing dual-track value realization.

- Growth and Consolidation Strategy: The companies are actively pursuing a proactive strategy to assess and undertake strategic acquisitions, aiming to accelerate growth and strengthen its industry position.

- Strong Proven Management Team: The combined company's management team will draw on the proven track record of both companies, with a combined skill set of mining development, operations, finance, exploration and community relations experience.

Meeting Information

The Meeting will be held at the office of DuMoulin Black LLP, 15th Floor of 1111 West Hastings Street, Vancouver, British Columbia on Wednesday, June 26, 2024 at 10:00 a.m. (Vancouver time), where Voting Securityholders will be asked to consider and vote on the Arrangement.

YOUR VOTE IS IMPORTANT - PLEASE VOTE TODAY

Blackwolf Securityholder Questions and Assistance

If you have any questions or require assistance voting your Shares or Options, please contact Blackwolf's transfer agent, Computershare Investor Services Inc. directly at 1-800-564-6253. If you have questions in your consideration of the Arrangement, please contact Morgan Lekstrom at 250-574-7350 or [email protected].

About Blackwolf Copper and Gold Ltd.

Blackwolf recently announced that it has entered into a definitive agreement with TML to combine the two companies, pursuant to which TML will acquire all of the issued and outstanding common shares of Blackwolf. See the Company's May 2, 2024 news release for additional information. TML is a gold-focused company with assets located in Canada. TML's Goliath Gold Complex Project is located in Northwestern Ontario. The Company holds a 100% interest in the high-grade Niblack copper-gold-zinc-silver VMS project, located adjacent to tidewater in southeast Alaska and five Hyder Area gold-silver and base metal properties in southeast Alaska.

For more information on Blackwolf, please visit the Company's website at www.blackwolfcopperandgold.com.

On behalf of the Board of Directors of Blackwolf Copper and Gold Ltd.

'Morgan Lekstrom'

CEO and Director

For more information, contact:

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Information

This news release includes certain 'forward-looking information' and 'forward-looking statements' (collectively, forward- looking statements') within the meaning of Canadian and United States securities legislation that is based on expectations, estimates, projections and interpretations as at the date of this news release. Any statement that involves predictions, expectations, interpretations, beliefs, plans, projections, objectives, assumptions, future events or performance (often, but not always, using phrases such as 'expects', or 'does not expect', 'is expected', 'interpreted', 'management's view', 'anticipates' or 'does not anticipate', 'plans', 'budget', 'scheduled', 'forecasts', 'estimates', 'potential', 'feasibility', 'believes' or 'intends' or variations of such words and phrases or stating that certain actions, events or results 'may' or 'could', 'would', 'might' or 'will' be taken to occur or be achieved) are not statements of historical fact and may be forward- looking information and are intended to identify forward-looking information.

Since forward-looking information address future events and conditions, by their very nature they involve inherent risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of factors and risks. These include, but are not limited to, expected timing and completion of the Arrangement; the strengths, characteristics and expected benefits and synergies of the Arrangement; receipt of court approval; approval of the Arrangement by Blackwolf securityholders and TML shareholders; obtaining TSX and TSXV acceptance to complete the Arrangement; the anticipated timing of the securityholder meetings of TML and Blackwolf to vote on the Arrangement; the expected delisting of Blackwolf shares from the TSXV; the composition of the post-Arrangement board and management team of the combined company; completion of the proposed consolidation; the ability of the combined company to successfully achieve business objectives, including integrating the companies or the effects of unexpected costs, liabilities or delays; expectations relating to future exploration, development and production activities; expectations relating to costs; expectations regarding financial strength, free cash flow generation, trading liquidity, and capital markets profile; expectations regarding future exploration and development, growth potential for TML's and Blackwolf's operations; availability of the exemption under Section 3(a)(10) of the U.S. Securities Act to the securities issuable in the Arrangement; the companies' assessments of, and expectations for, future business activities and operating performance; expectations regarding the completion of TML's concurrent financing on substantially the same terms set out herein or at all; delays or changes in plans with respect to exploration or development projects or capital expenditures; the uncertainty of mineral resource, production and cost estimates; health, safety and environmental risks; worldwide demand for gold and base metals; gold price and other commodity price and exchange rate fluctuations; environmental risks; competition; incorrect assessment of the value of acquisitions; ability to access sufficient capital from internal and external sources; and changes in legislation, including but not limited to tax laws, royalties and environmental regulations. Actual results, performance or achievement could differ materially from those expressed in, or implied by, the forward-looking information and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking information will transpire or occur, or if any of them do so, what benefits may be derived therefrom and accordingly, readers are cautioned not to place undue reliance on the forward-looking information.

For more information on the Company, investors should review the Company's continuous disclosure filings that are available at www.sedarplus.ca.

___________________________________________________

1 For information on the GGC Project, please refer to the technical report on the GGC Project entitled 'Goliath Gold Complex - NI 43-101 Technical Report and Prefeasibility Study' dated March 27, 2023 with an effective date of February 22, 2023, which is available on TML's SEDAR+ profile at www.sedarplus.ca.

2 Cash cost and AISC are non-GAAP financial measures and have no standardized meaning under International Financial Reporting Standards and may not be comparable to similar measures used by other issuers. As the GGC Project is not in production, TML does not have historical non-GAAP financial measures nor historical comparable measures under IFRS, and therefore the foregoing prospective non-GAAP financial measures may not be reconciled to the nearest comparable measures under IFRS. See 'Non-IFRS Measures' in TML's management's discussion and analysis for the year ended December 31, 2023 for further details.

SOURCE: Blackwolf Copper and Gold Ltd

View the original press release on accesswire.com

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New Jersey Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New Jersey Telegraph.

More InformationBusiness

SectionFord to invest up to $4.8 billion to revive struggling German unit

FRANKFURT, Germany: Ford announced this week that it will inject up to $4.8 billion into its struggling German unit to stabilize its...

Boeing links worker bonuses to company-wide performance

SEATTLE, Washington: Boeing has revamped its employee incentive plan, tying annual bonuses for more than 100,000 workers to overall...

US, Canadian farmers face rising fertilizer costs amid trade tensions

WINNIPEG, Manitoba: Farmers in the U.S. and Canada are bracing for soaring fertilizer prices as trade tensions escalate between the...

U.S. stocks stabilize after relentless losses

NEW YORK, New York - A slightly lower-than-expected CPI reading for February helped U.S. stocks to stabilize after some relentless...

New York office market rebounds as big investors hunt for deals

NEW YORK CITY, New York: New York's office market is showing signs of a comeback as major investors, including Blackstone, scout for...

Micro-wineries in Cyprus bring ancient Commandaria wine back to life

NICOSIA, Cyprus: Cyprus' ancient Commandaria wine, praised for its rich heritage dating back nearly 3,000 years, is making a comeback...

International

SectionFighter jets intercept plane near Trump’s Florida home

WEST PALM BEACH, Florida: Air Force fighter jets have stopped a civilian plane that entered restricted airspace near Donald Trump's...

US farmers face bankruptcy, economic uncertainty due to USDA freeze

CHICAGO/WASHINGTON, D.C.: Farmers and food groups across the U.S. are laying off workers, stopping investments, and struggling to get...

South Dakota law blocks eminent domain for carbon pipelines

SIOUX FALLS, South Dakota: A new South Dakota law banning the use of eminent domain for carbon capture pipelines has cast doubt on...

US intelligence agency orders DEIA officials to resign or face firing

WASHINGTON, D.C.: Officials working on diversity and inclusion programs at the U.S. Office of the Director of National Intelligence...

CDC study follows measles outbreak amid declining vaccination rates

WASHINGTON, D.C.: The U.S. Centers for Disease Control and Prevention (CDC) is planning an extensive study on possible links between...

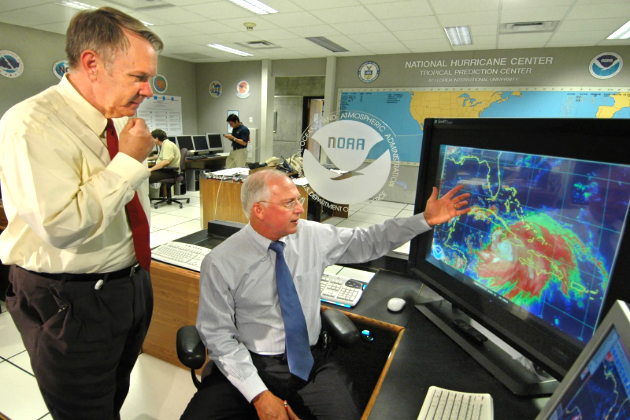

US weather agency faces big layoffs under Trump’s civil service cuts

WASHINGTON, D.C.: The U.S. weather agency, NOAA, plans to lay off 1,029 workers following 1,300 job cuts earlier this year. This...