Citigroup mistakenly credits $81 trillion to customer instead of $280

Robert Besser

04 Mar 2025, 11:57 GMT+10

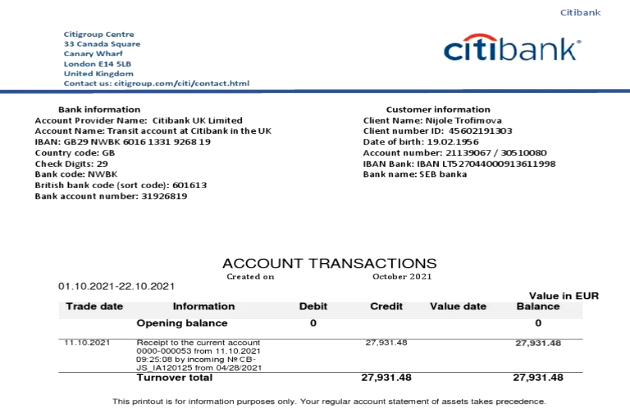

- A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280

- The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address

- According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day

NEW YORK CITY, New York: A routine banking transaction at Citigroup last April turned into a major blunder when the bank mistakenly credited $81 trillion to a customer's account instead of US$280, according to a report by the Financial Times (FT) this week.

The error, which took hours to reverse, was caught internally before any funds left the bank, but it underscores persistent operational challenges Citigroup has been working to address.

According to the FT report, two employees responsible for reviewing the transaction initially missed the mistake before it was processed the next day. A third employee finally caught the issue an hour and a half later, prompting the bank to reverse the incorrect credit several hours after it had been processed.

Citigroup disclosed the incident—which qualifies as a "near miss" because no funds were lost—to U.S. regulators, including the Federal Reserve and the Office of the Comptroller of the Currency (OCC).

In response to inquiries, a Citi spokesperson told Reuters that the bank's "detective controls" quickly identified the ledger entry mistake and reversed it before it could impact the customer or the bank.

This isn't the first time Citigroup has faced scrutiny over its risk management systems. According to an internal report reviewed by the FT, Citigroup recorded 10 near misses of $1 billion or more in 2023, down slightly from 13 the previous year.

The bank has been under regulatory pressure to improve its internal controls. In 2020, Citi was fined $400 million for issues related to risk management and data governance, and in July 2023, it was fined an additional $136 million for failing to make sufficient progress in fixing those shortcomings.

Citigroup's Chief Financial Officer Mark Mason acknowledged last month that the bank is investing more in technology, data management, and compliance to strengthen its risk oversight.

"We saw the need to invest more in the transformation on data, on technology, on improving the quality of the information coming out of our regulatory reporting," Mason said.

Citigroup continues to strengthen its internal processes to reduce the frequency of such high-stakes errors. While the $81 trillion mistake was caught in time, it serves as a reminder of the risks associated with large-scale banking operations—and the importance of robust oversight mechanisms.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of New Jersey Telegraph news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to New Jersey Telegraph.

More InformationBusiness

SectionHollywood pushes for more tax breaks to keep productions in LA

LOS ANGELES, California: Over the weekend, hundreds of Hollywood workers, including crew members, producers, and actors, asked California...

EU official warns of harsh impact from new US tariffs

ATHENS, Greece: As Europe braces for the economic fallout of new U.S. tariffs, a top eurozone official has warned the consequences...

Soaring prices squeeze Bolivian families amid 20-year inflation high

LA PAZ, Bolivia: Rising prices are changing daily life for Bolivians, forcing families to cut back as inflation hits its highest levels...

Nasdaq Composite surges more than 12% as Trump agrees he misfired

NEW YORK, New York - U.S. stocks roared back to life on Wednesday after U.S. President Donald Trump back flipped on his recently announced...

Texas probes WK Kellogg over ‘healthy’ label claims

AUSTIN, Texas: Attorney General Ken Paxton announced over the weekend that the state has launched an investigation into a company,...

Jaguar Land Rover halts US exports amid new tariffs

LONDON, U.K.: Jaguar Land Rover has become one of the first major carmakers to pause exports to the United States in response to the...

International

SectionMississippi and Kentucky move toward ending income tax

FRANKFORT/JACKSON: It is been about 45 years since a U.S. state last got rid of its income tax on wages and salaries. But now, Mississippi...

Electric utilities feel the heat as AI needs soar

NEW YORK CITY, New York: As artificial intelligence drives soaring demand for data processing, electric utilities across the United...

Deadly storms flood Kentucky, pose threat to lives, homes

FRANKFORT, Kentucky: Heavy rain over several days caused rivers to overflow across Kentucky, flooding homes and threatening a famous...

Ukraine, US resume talks on critical minerals deal

KYIV, Ukraine: Talks between Ukraine and the United States over a critical minerals agreement are set to continue this week, as officials...

SpaceX, ULA, Blue Origin win $13.5 billion in space force contracts

WASHINGTON, D.C.: Elon Musk's SpaceX, Jeff Bezos' Blue Origin, and United Launch Alliance (ULA) won U.S. military contracts worth US$13.5...

IRS begins major layoffs, civil rights office hit first

WASHINGTON, D.C.: The U.S. Internal Revenue Service (IRS) began laying off workers late last week, according to an email sent to staff,...